A Decision Making Framework for Innovative Leaders, Part 4: Going from Zero to ROI

This is part four of the series. Feel free to start here, or go back to start with Part 1: Embracing Uncertainty, Part 2: Assessing Risk vs. Opportunity, or Part 3: The Risk of Not Doing.

Welcome back! You’ve taken some critical steps that have moved you from the unknown to pushing forward in your organization’s growth initiative. If you’re still scared, that’s normal – it’s still the unknown. But here’s where we will establish metrics that will create certainty. If you have a strong plan in place for quantifying what you are learning within your realm of the uncertain, you are going to de-risk your initiatives significantly. Measurement, as inputs, propels our understanding of the potential outcomes of the decisions we make.

No matter what your role is in your organization, your objectives have to be tied directly to overall business impact to drive long-term growth. Too many companies get sucked into “feel-good” numbers like – impressions or how many “likes” a social media post attracts. These are vanity metrics, they do not measure what matters. Do website visitor increases convert to demos booked or shopping cart conversions? Did social engagement drive an uptick in new customers or average cart value? Or, are they just numbers obscuring a less obvious truth about the health of your company?

As strategists, we use as much evidence as we have to decide how we pursue growth. And that requires measurement. So, what are we measuring and why?

KPIs vs. ROI

KPIs or key performance indicators show how you are performing against goals. KPIs look forward, providing short-term organizational health insights that enable leaders to optimize performance along the way.

Some of the KPIs we measure:

- Lead-to-customer conversion rate

- Customer lifetime value

- Customer retention rate

- Viral quotient

- Net promoter score

In a vacuum, each of these only tells one view of a success story. Looking at them all together helps piece together a picture of the value you are delivering to your customers – where patterns of opportunity for optimizing and delivering greater value begin to emerge.

ROI or return on investment looks back at the bigger picture. ROI measures the value we are creating for the organization. Some organizations define value as bottom-line revenue. For others, it might be a robust product pipeline. Others still, may define value as failing fast enough to minimize investment risk in new ventures or innovation pursuits.

Part of what you’ll need to align on with your team is how you define ROI. Then, you’ll need to make sure you have a plan in place for collecting, analyzing, and executing your data insights. It isn’t easy to assess either KPIs or ROI without reliable data. Even if your organization isn’t ready to make your data actionable, start collecting data now. It’s easier to create a plan and make sense of historical data if you have it, rather than to start from nothing once you’ve decided you are ready.

Ok, here’s where we talk about actually achieving your ROI.

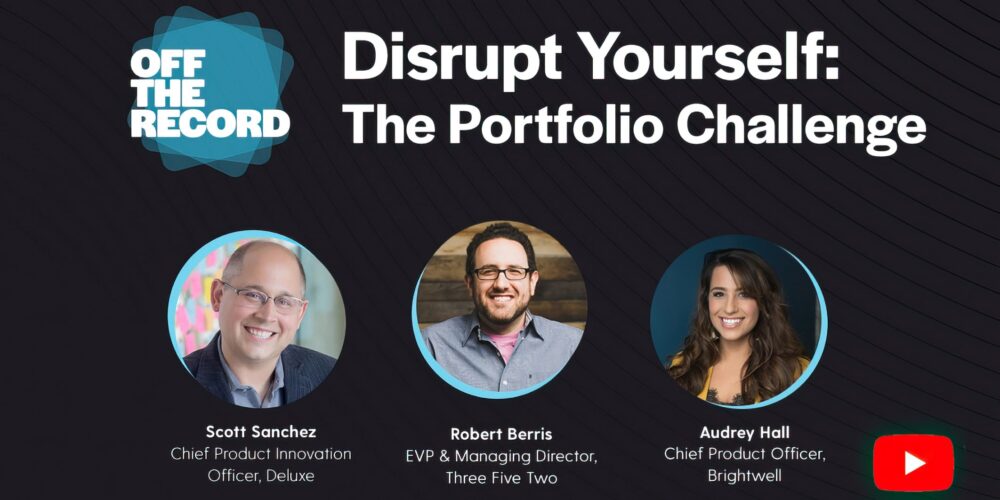

At Three Five Two, we’re a team of designers, developers, technologists, researchers, marketers, strategists, and within all of us, we have a few shared passions:

- Data: we want evidence to suggest we’re “doing the right thing”

- User-centered: we aspire to create solutions that solve problems for people

- Fastest path to validation: lean is in our blood, which means whatever helps us arrive at the future together fastest, is where we want to be. And that future is always about the next decision to drive growth, even if that means killing it. That will drive growth because it ceases to be a drag on resources to focus on something else.

There are many “ways” to get to revenue. Which way should we take?

1 – Highest Product Confidence; Slower to Market – Conducting rounds of qualitative research to validate hypotheses we have until we feel confident that we know both the problem to solve for people and a solution that meets that need or…

2 – Moderate-High Market Confidence; Slower to Market – Running marketing and advertising campaigns in-market to measure interest in a product that doesn’t exist yet or…

3 – Highest Risk; Fastest to Market – Quickly building a digital product for consumers to use immediately and marketing to a small group of them for a pilot.

Each of these is a valid route to market on its own and in combination with each other. Since every initiative is different, we must understand their use because they are all within the front-end of innovation or the product life cycle.

Getting meta: Let’s unpack this blog series

So let’s stop talking and start doing. There’s a few grounding tools I want you to use which serve as the foundation for your thinking. We’ll use the premise for this article series to talk through the various tools.

- The Who, What, How

- Learning Agenda

- Keep it short – and Keep it light

1. Controls – The Who, What, How

These three elements are your “controls.” Generally, in the beginning of any work to find something new, all three of these are unknown and therefore you have to take a leap of faith on each. To be real specific, my who within this article series are: Product & Digital Leaders, Marketing Leaders, Innovation Leaders, and General Managers.

The what is the definition of the problem we’re solving for.

In this case, the what for the 4 personas above, is that it’s difficult to make major business decisions due to a lack of confidence from evidence. And the larger the opportunity, the higher uncertainty, therefore these leaders feel the tension between their responsibility to find big growth and to assess the risk vs. opportunity at the same time.

And finally everyone’s favorite, the how…

which is your solution to fix this. In my case, I’m providing a framework we use to navigate the uncertainty, by providing a structure to uncertainty. By identifying and defining your unknowns, creating a plan for converting them into knowns, we reduce our fear.

Said in a much simpler way, “If I can identify exactly what I don’t know, it’s easier to create a plan to understand them. And if I can understand them, I can make a decision about what to do next.”

So let’s pretend An example – if you’re in the automotive industry, your who is: customers who buy cars. Your what is: how painful the process to purchase a car is… that’s enough to begin. Because, in the beginning, you may not know any more than that. In fact, it’s almost better that you don’t have a how early on; it’ll blind you to the problems you’re actually trying to validate through this experience.

2. Learning Agenda

Once you’ve defined your who and what, that’s enough to create a learning agenda. It’s an artifact you might recall from Part One – where we define all of our assumptions, unknowns, and hypotheses. Once an entire team defines these objects on the board, as it were, you now have to assess how important it is to learn about each of them and how uncertain the team is about each.

I mention this step again because of its role in the success of your team and your product. Why? No matter what your organization’s comfort level with risk and uncertainty, you have to keep an eye turned toward what you need to learn. This is especially true if you base much of your approach on assumptions to get to market faster.

Use this free Learning Agenda Template to get started.

After your team has mapped its assumptions, unknowns, and hypothesis, have your team dot-vote how uncertain each is and how important it is to learn each. This should help your team use the best knowledge available in the room to focus on what to learn. And like I described before, this process quickly exposes any misalignment that exists in your team.

There isn’t a sweet spot that says you should focus on three of these statements vs. 10. Still, when you cluster them together by subject matter, you should begin to see many topics emerge. I might advise focusing on less than five to start. You’ll begin to see how good your team is at keeping the work focused, and it will be evident by how much you can get done during a time with research participants.

At Three Five Two, we start every project, whether research, development, marketing, data, or business strategy, by co-creating this Learning Agenda with our clients. It is one of the first exercises that bonds our teams together, displays how everyone thinks in the room, and exposes what is generally important to each team member. It’s an excellent opportunity to develop empathy for each other and provide greater clarity on what your team wants to accomplish together.

3. Keep it Short & Keep it Light

In the most straightforward framing, think about this through the lens of knowledge vs. time. There are numerous ways to get something to market, and no way is really “wrong” if the goal is to learn. You will learn something no matter what.

Many companies conduct little to no research and instead take the path of solutions-thinking. They create an entire idea conceptually, write a functional requirements document and have a team build their concept. Three, six or even nine months later, they’ve built a solution. That’s one path to market. But those companies may not have any certainty that the market desires their product.

Guess what? I can create a low-fidelity paper prototype to test if that same “concept” meets a user’s underlying need in less than a week.

If it were me, I’d rather speak with six people in a week than spend six months developing a product no one’s ever used. That’s the tension we’re talking about when balancing speed to market with risk and uncertainty.

Ok, so you told me a lot about research, but when do you get to a lean digital product or marketing campaign?

I already did.

Here’s the deal, the structure of:

- A documented list of unknowns, hypotheses, and assumptions

- How uncertain and important they are

- The length time time you want to spend learning

- And how deep the learnings you need are…

…are exactly the same way to think for a low-fidelity prototype and research sprint, a lean digital product or a marketing interest campaign.

So, whether you’re running a research experiment, creating a product, or even doing a test marketing campaign to receive some feedback at scale, you can easily gain certainty about what you want to accomplish.

Yesterday, you spoke with exactly zero people. Today, you could talk to 10, or 20, or 1,000 in whatever format you choose. All of our decisions come with implications.

The length of time it takes to gather evidence to support a confident business decision is equal to the uncertainty you and your team feel.

So, it all comes down to what’s critical to learn, how much time do you want to spend on learning it, and how much “quality” does your process need? Quality is synonymous with fidelity and in this case, here’s a great way to think about it:

Do I need to build an entire restaurant to learn if this will be a successful business?

Or, could I create a sample of my food and give it away to people on the street?

Or, could I make a menu and ask people what they think about it?

This mindset should be taken seriously as it relates to a new product, service, or business model. You can learn a lot, with something as simple as a menu.

Make sense? Sure, in each of these scenarios you may lean on “Lean Startup” to create a minimally viable product, or Traction Marketing to craft specific channel-based experiments, but ultimately that’s not what I’m here to teach:

Suppose you can accept that it’s possible to learn from your customers with different depths of confidence, fidelity, and time invested. In that case, I hope I opened your mind to the idea that all of these paths represent the response to your user or customer’s problem. And the faster you learn and repeatedly validate their response to your solution, the quicker you’ll know if you have uncovered a new growth opportunity for your business.

Now, let’s get together and make it happen.

I appreciate your time reading this series of posts. It’s a lot to digest, but my hope is that I may have changed the way you think about moving from zero to ROI. I also hope I’ve lived up to my team’s standard of what they jokingly call the PLF (the plain language framework).

This work is full of buzzwords, academic sounding nonsense, but them the breaks sometimes.